Federal fair housing laws prohibit discrimination in the sale, rental and financing of housing based on race, color, national origin, religion, gender, disability and whether people have children.

At Zillow, we shine a spotlight on fair housing research and also on the people who are helping to make homeownership accessible to all. Among those helpers are housing counselors, many who are certified by the U.S. Department of Housing and Urban Development. Their job: To help low-to middle-income home shoppers become mortgage-ready.

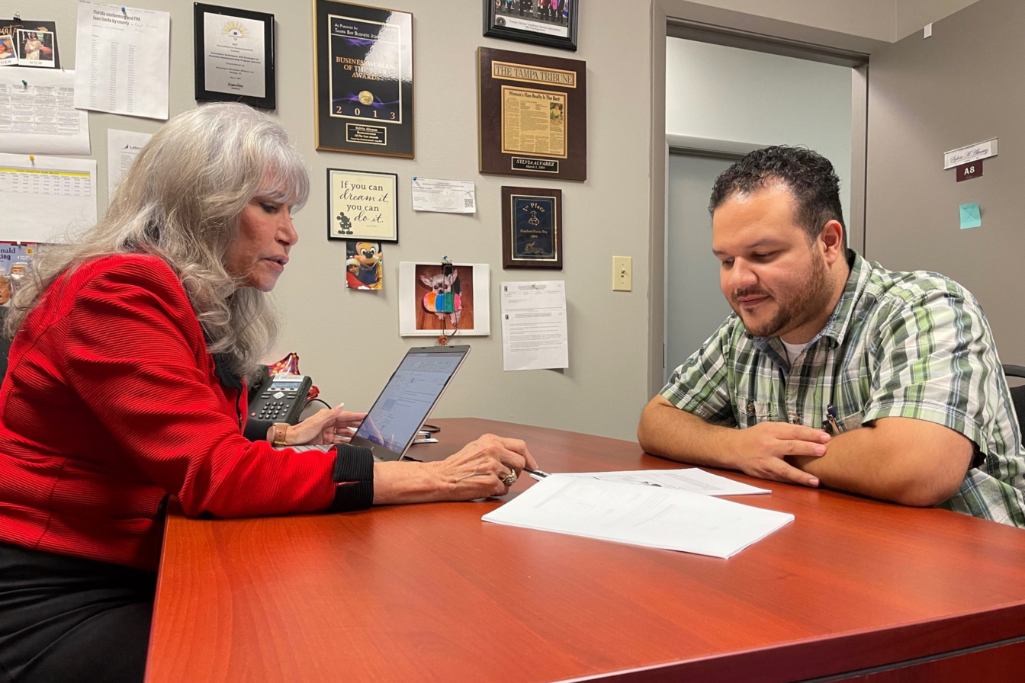

To understand how first-time homebuyers can tap this resource to realize their dreams of owning a home, we spoke with Sylvia Alvarez, the founder and Executive Director of the Housing and Education Alliance (HEA), a HUD approved housing counseling agency serving over 47,000 Tampa Fla. area residents since 2002.

What is a HUD-certified housing counselor?

Housing counselors help prospective homebuyers make informed decisions about if — and when — they should become homeowners. They are an uninterested third party that helps homebuyers make informed decisions during their homebuying process. Counselors must take extensive training, have years of experience in housing issues and pass a HUD certification exam that demonstrates their ability to explain the homebuying and financing process.

“Buying a home is complicated with a lot of moving pieces. It’s so important that people get educated before they make mistakes.” — Sylvia Alvarez

Housing counselors work for HUD-approved non-profit agencies, like mine. There are more than 2,000 across the country, which are funded by government grants and donations from lenders and local business leaders who support affordable housing and financial education. Counseling services are usually free, or at very low cost to clients. The easiest way to find a local housing counselor is through HUD’s online directory.

How is the advice a housing counselor gives different from what people can get from a real estate agent or lender?

A housing counselor is an independent advocate for the homebuyer, and works in concert with all the different players, the real estate agent, the lender and with the municipality that may be able to offer the buyer down payment assistance. We’re sort of like the hub and our spokes go out to these partners. Housing counselors protect the consumer. We want to make sure that consumers make the right choices and are educated, so that they know when something is good and when something is not.

What things are you on alert for on behalf of homebuyers?

We advocate for buyers to choose the right mortgage. And we don’t recommend anything except a fixed-rate loan. It would be disastrous for a first-time home buyer to get an adjustable rate, or a complicated hybrid loan. I’ve had clients come to me saying “this is fixed for five years, isn’t that a fixed rate?” And I say “no, after that it’s going to adjust.” That’s the wrong mortgage because the interest rate can go up a lot. If they are eligible, we help them connect with the best down payment assistance program that can help them with upfront costs. We make sure they don’t make a mistake because the slightest mistake could turn into a financial disaster.

Describe what type of housing counseling you offer.

It starts with an eight-hour group class. The one we developed is called HomeTRACK Online. It’s “EDU-tainment” with games, cartoons and funny videos. 90% of any questions people have are answered in this class. At my organization, we deliver the class over three nights. We make it fun, and clients learn a lot and retain what they learn — studies show that with humor, retention levels go up. Sometimes we’ve got 50 to 70 people in a class (now done via Zoom), clients come from all over the U.S., including some from rural areas where people don’t have access to a housing counseling agency.

At the end of the class, there’s a final test, and if you pass, you get a certificate. Many lenders require a certificate of attendance for down-payment assistance. After that, clients are required to turn in certain documents, we pull a credit report and then we have a one-on-one counseling session to go over their specific situation.

What typical issues do you tackle in a one-on-one session?

When we first meet with a client, we assess them, “are they mortgage-ready now, or maybe in three months, six months?” People may need to pay down some bills, make payment arrangements for collections, find a way to earn more income and each case is unique. We explain what they need to do to get pre-approved for a mortgage and the steps to take to get there. Then we give them names of three agents and three lenders who have the best loan programs, and we’re clear these are suggestions, you can choose anybody you want as long as they are approved for the program they want to apply for. They are the boss in the transaction.

Many people think their credit score is the most important thing to get approved for a loan. True?

No. There are four components to getting approved, the “Four Cs:” credit, capital, collateral and capacity to pay back the loan. You can have one, but if you don’t have any of the others, you’re not going to get approved. You have to have all four Cs.

What about the clients who are one-year — maybe many years — away from being mortgage-ready? Can you help them?

My agency has a program called HAP, the Homeownership Advancement Program, where we give credit- or cash-challenged clients an action plan to get them mortgage ready. Some may have bankruptcies or foreclosures and it may take two years, or however long it takes, we’re here to help and are there for them.

At my agency, once they take the 8-hour course, the only cost they pay is to pull a credit report, which is $18. We’ll tell them what they need to do, for example, contact the creditor, see if you can negotiate a payment arrangement, also, getting clients to where they’re using under 30% of all their available credit. People do get discouraged, and we say, “You didn’t get in this predicament overnight and you’re not going to get out of it overnight. If you really want to do this, we will give you the tools and get you there.”

What’s your biggest piece of advice for people thinking about working with a housing counselor?

Buying a home is complicated with a lot of moving pieces. Don’t just come to get the certificate. It’s so important that people get educated before they make mistakes. If a loan program requires a certificate, it is usually not required to be provided until closing. This can be a disservice because people like that aren’t really committed to learning about the homebuying process. I’ve had clients who’ve already put money down for appraisals or home inspections. And they say, “boy, I wish I’d taken this class earlier — I never would have done that.”

April is Fair Housing Month, which Zillow is observing in part by shining a light on data that shows the gaps in homeownership rates between Blacks and Hispanics and whites. To what extent do you see your work as narrowing that gap?

That’s what we do. I would say at least 80% or more of the people that we work with are low to moderate income buyers, most minorities, most Black or Hispanic. We are closing that gap. The title companies love our closings because people cry, but they’re happy tears. Sometimes the work is overwhelming because there’s so much to be done. But it makes me feel so good, especially when we help that client who never thought they’d buy a home. I put together a video of students who talk about what they learned. I send it to all my new housing counselors. It reminds me why we do what we do.

Sylvia Alvarez is the founder and Executive Director of the Housing and Education Alliance (HEA). She co-authored The American Nightmare: Strategies for Preventing, Surviving and Overcoming Foreclosure. The book is endorsed by Freddie Mac and the National Association of Hispanic Real Estate Professionals, translated into Spanish and used by consumers and HUD housing counselors throughout the country.

Related: