Rapidly rising home prices have made it harder for first-time buyers to save for a down payment and compete for a home. Some are landing homes by eschewing the traditional 20% down payment and buying with as little as 3%–5% down. A new Zillow survey finds that a majority (64%) of first-time buyers put less than 20% down on a house, and a quarter of those surveyed put down 5% or less.

It’s a strategy that has been successful in the hot pandemic housing market, but one that comes with risks. That’s why the housing experts at Zillow and the financial pros at Betterment are weighing the options to help home buyers decide how much of a down payment is right for them.

5% Down Payment

When considering how much to save for a home purchase, it can make a lot of sense to buy a home with less than the standard 20% down payment. Home price appreciation and rent increases are far outpacing income growth, and the additional savings will likely take years to collect.

Consider a first-time home buyer who purchased a typical U.S. home, valued at $298,933, in July 2021. A buyer putting only 5% down would be required to pay private mortgage insurance, known as PMI, which can add to the buyer’s monthly payment. Using the Zillow mortgage calculator, that buyer would end up paying approximately $370 more per month compared to the home buyer who put 20% down, due to the larger principal balance on the loan as well as the extra cost of PMI.

By August, the typical U.S. home had appreciated by almost $5,000, so the home buyer who put only 5% down has still come out ahead, even with a higher monthly payment. Keep in mind, this summer brought the fastest monthly home price appreciation on record. While Zillow’s economists expect to see homes continue to appreciate in value over the short term and long term, it’s probably best not to bank on this kind of rapid growth lasting forever.

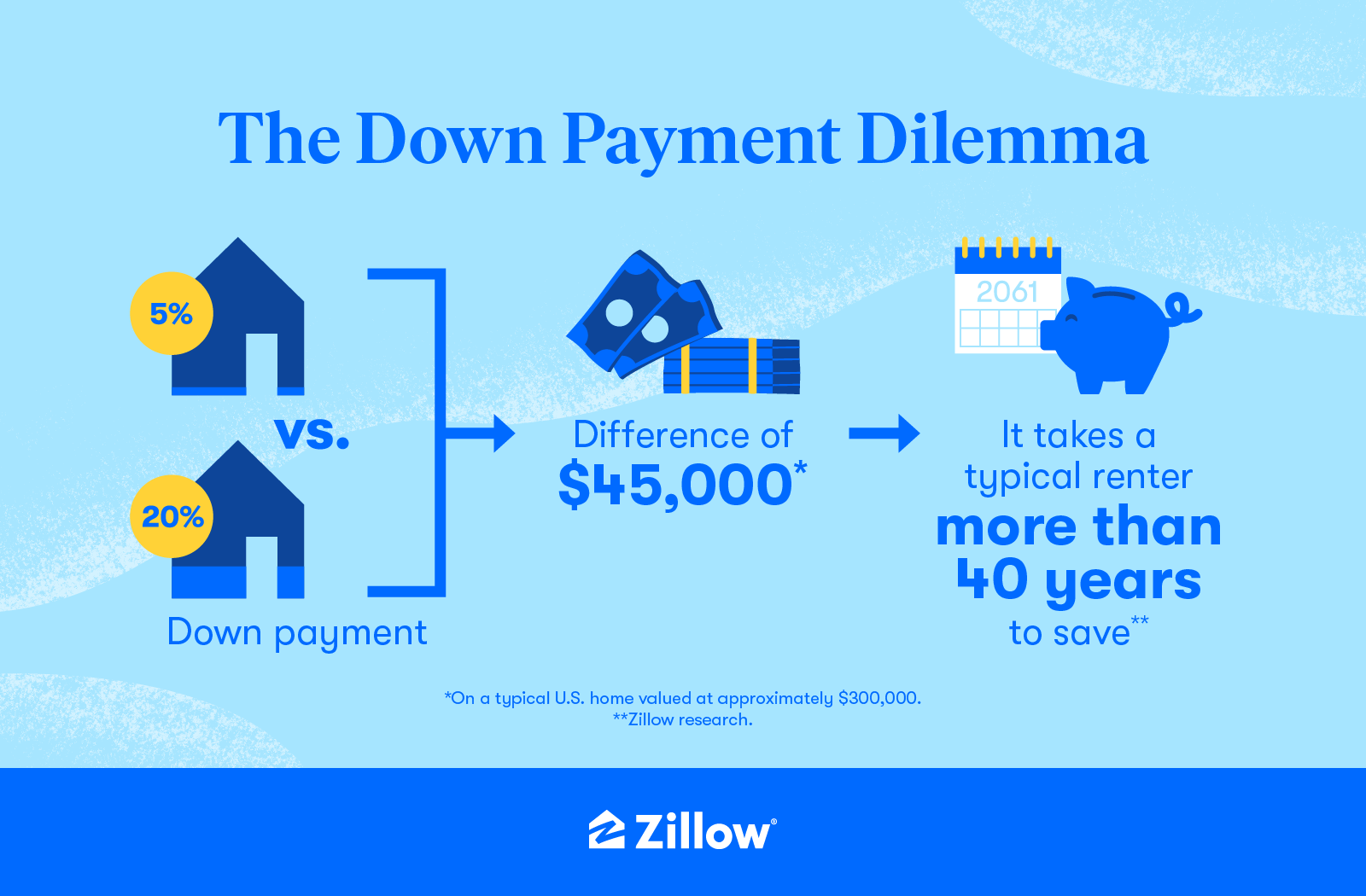

The typical U.S. home is worth about $300,000. A 5% down payment on that home would be $15,000, while a 20% down payment would be $60,000 — a difference of $45,000. According to Zillow research, it could take more than 40 years for the typical renter to save that additional $45,000 (under the most conservative assumptions). Meanwhile, the home that could have been purchased with a 5% down payment in July 2021 will likely continue to gain value.

The wealth-building benefits of homeownership can often outweigh the added expenses that come with a lower down payment and/or the added time of waiting to save for a larger down payment.

— Cory Hopkins, Zillow economic manager

“In today’s red hot market, it could be okay to put only 5% down on a home if that’s what you can afford,” says Zillow’s economics manager, Cory Hopkins. “The wealth-building benefits of homeownership can often outweigh the added expenses that come with a lower down payment and/or the added time of waiting to save for a larger down payment. However, we expect the pace of appreciation to relax over time as we move toward a more balanced housing market, meaning buyers shouldn’t expect or rely on these extreme monthly or yearly equity gains.”

It’s important to keep in mind that a 5% down payment can present more risks than a traditional 20% down payment. The biggest risk of a low down payment is the chance of not being able to sell the house for enough to pay off the loan — a condition known as being “underwater” on the mortgage. A lower down payment could also hurt a buyer’s chances in a competitive market when a seller has multiple offers to choose from.

Home buyers need to assess their own personal financial situation, job security, economic conditions in their metro area, how long they plan to live there and their own risk tolerance when deciding whether to put less than 20% down on a home.

20% Down Payment

A 20% down payment has long been the gold standard of purchasing a home because it often qualifies buyers for a lower mortgage interest rate and a lower monthly payment, avoids the need to pay PMI and gives new homeowners sizable equity in their home on day one.

Nick Holeman, head of financial planning at Betterment, says a 20% down payment helps buyers avoid overextending themselves on their mortgage. A higher down payment reduces monthly payments, and Holeman says that allows buyers to save for other financial goals, like retirement.

“Homeownership can be a great investment. Our research finds that on average, it roughly keeps pace with the stock market, with the expected return of both investments falling between 8.6% and 10% per year,” Holeman says. “But that doesn’t mean buyers should leverage themselves up to the nines and buy the single biggest house they qualify for. They may want to aim for a $450,000 house instead of the $600,000 home they’ve been looking at.”

Holeman recommends buyers amass a financial safety net to cover three to six months of expenses before gathering the money for a down payment. But he points out that first-time home buyers who have money locked up in an IRA can avoid the 10% penalty for early IRA withdrawals if they use the money for a home purchase, up to $10,000.

Holeman has three strategies that can help would-be home buyers overcome the growing obstacle of saving for a down payment:

- Start planning and saving early, ideally from one to three years before you want to buy, and check in often to make sure you are meeting your savings goals.

- Contribute to an investment portfolio for the potential to realize gains much more quickly than saving alone.

- Automate your contributions to make sure you stay on target.

- Explore down payment assistance and lending programs, such as FHA loans, to see if you qualify.

To learn more about the true costs of homeownership and other pertinent topics for home shoppers and owners, check out the Ask Zillow Anything video series, presented by Betterment. The digital series features real estate and financial experts addressing questions, including when to consider new construction and how to prepare for buying your first home.