The Zillow guide for first-time homebuyers

If you’re thinking about buying your first home but don’t know where to start, you’re not alone. Listen to our webinar for expert advice on how to get started, finding the right agent and understanding financing.

Watch now – The Zillow guide for first-time homebuyers

Home-buying experts answer what first-time buyers need to know in this 30-minute webinar. Hear from the pros on how to successfully get home in today’s shifting housing market.

- Agent Hannah Farbstein Higgins advises how to find the perfect real estate agent and answers your questions about the true costs of buying a home.

- Zillow Senior Economist Kara Ng debriefs current housing market trends and answers key questions, including when is the best time to buy and how much to save for a down payment.

- Zillow Host Lindsay Cohen, one of Zillow’s homebuying experts, keeps the pertinent questions coming and draws on her own experience as a first-time buyer in the middle of the process.

Affordability + financing: FAQ

What are the best tools to determine affordability?

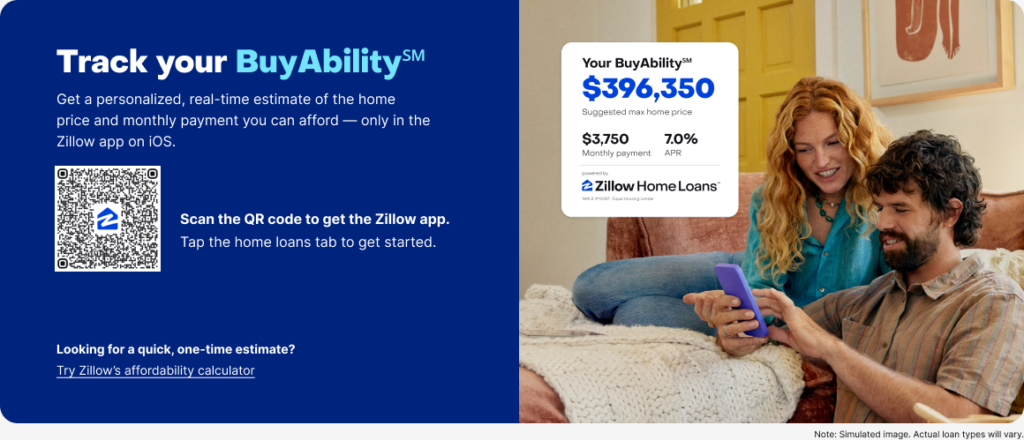

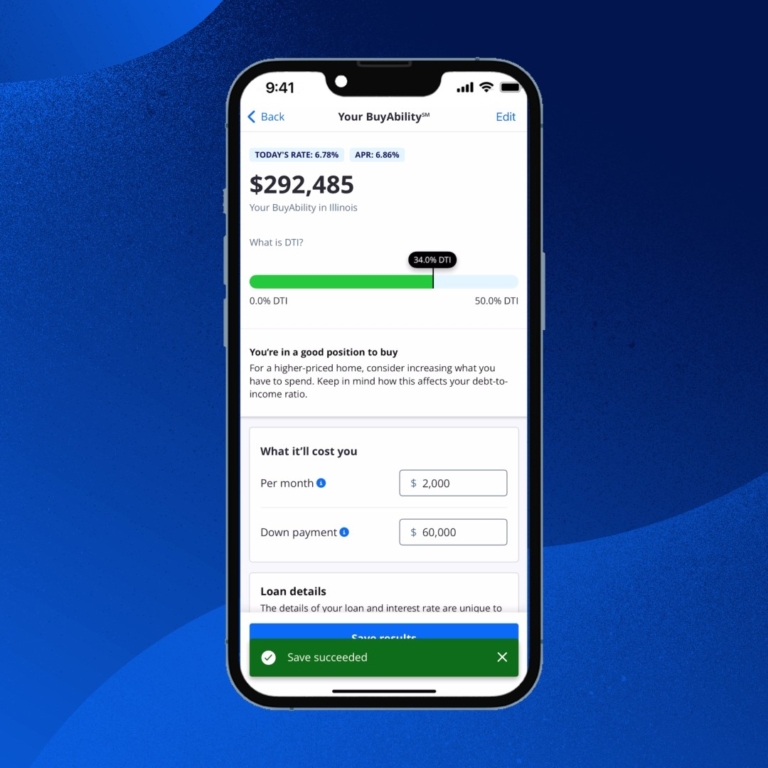

BuyAbility, a new tool from Zillow Home Loans, helps you understand what you can afford in real-time. After a quick, one-time set-up process, you’ll gain ongoing visibility into what homes are in your budget. We use current interest rates, your credit score, where you’re shopping, and your estimated down payment to determine your affordability. With tailored monthly payment estimates, labels that show how each home you search fits within your budget, and home recommendations based on your BuyAbility, we’ll help you find a home you love and can afford.

How much do I need for a down payment?

The typical down payment on a home is between 3% and 20% of the purchase price, but it can vary depending on the type of loan you go with. The typical buyer puts down between 10-19%, but 16% of buyers in 2022 put down just 3-5%. There’s no right answer, and it depends on your unique financial situation.

What is DTI?

DTI is your debt-to-income ratio. Your DTI is the share of your gross monthly income that goes toward paying your debts. It’s used by mortgage lenders to determine your ability to make timely monthly payments and pay back the loan. The lower your DTI ratio, the more likely you’ll be able to afford a mortgage and get approved for a loan. A DTI of 20% or below is considered excellent, and a DTI ratio of 36% or below is considered ideal. Zillow Home Loans’ BuyAbility tool will calculate your DTI ratio for you. You can get started on the Home Loans tab in the Zillow app or through the QR code above.

What credit score is needed to secure a mortgage?

A favorable credit score to buy a house is typically in the high 600s and 700s, with anything higher than that considered exceptional. However, some loan types will allow you to buy a house with a credit score as low as 500. It is possible to buy a house with a wide range of credit scores, but it’s important to remember that the higher your credit score, the lower the mortgage rate you’ll qualify for.

Related: Top questions to ask a mortgage lender & Is an adjustable rate mortgage right for you?

Related: Benefits of real estate agents for home buyers & Tips for hiring a buyer’s real estate agent