Resources for media and makers

Today’s housing market is still a tough one to navigate. Lower mortgage rates and smaller rent hikes are improving the affordability picture for both buyers and renters, but shelter costs remain far higher than before the pandemic.

Data, insight and financial literacy are key to making smart financial decisions on housing.

Check out Zillow resources and tools that can help make sense of this challenging market.

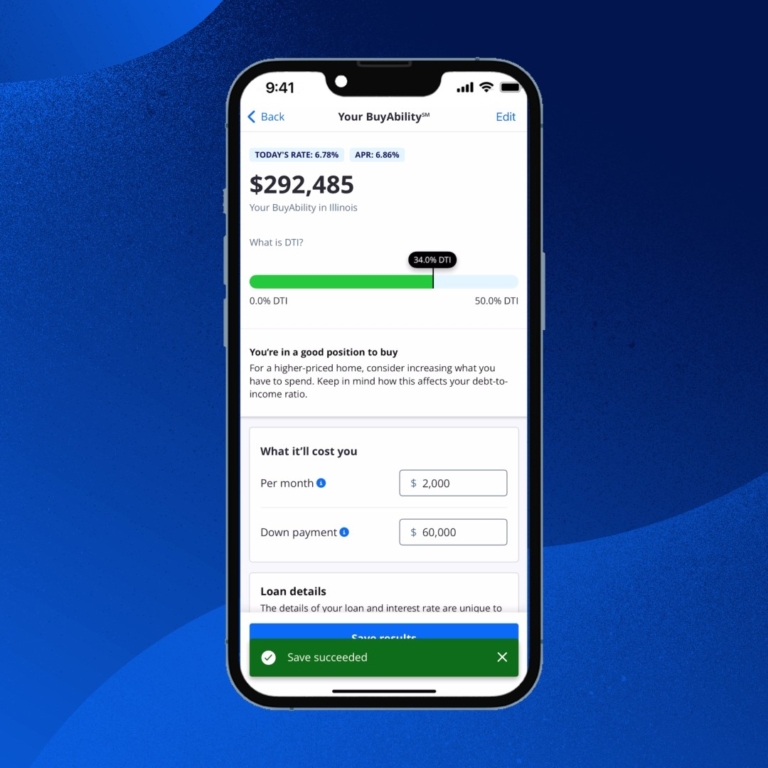

Understanding BuyAbility

This unique tool offers buyers a personalized estimate of the home price and monthly payment that suits their budget. Powered by a buyer’s credit score, income and down payment, and updated regularly to reflect current mortgage rates, home shoppers are provided with a true understanding of their buying power.

Learn more about:

Downloadable demos and images:

The affordability challenge

Mortgage affordability is still a serious concern for prospective homebuyers, especially those looking to make their first home purchase. Mortgage payments on a typical U.S. home are roughly double what they were before the pandemic, while higher rents have made it harder to save up a down payment.

Fortunately, home buyers are receiving significant relief lately as mortgage rates have declined from springtime highs. Competition is receding as inventory recovers, and improved affordability means more options fit into buyers’ budgets.

Zillow Research: Buyers Need a $127,000 Down Payment to Afford a Mortgage Payment

Search by monthly payment

Using the Zillow app, home shoppers can now filter your search to find homes that fit your monthly budget.

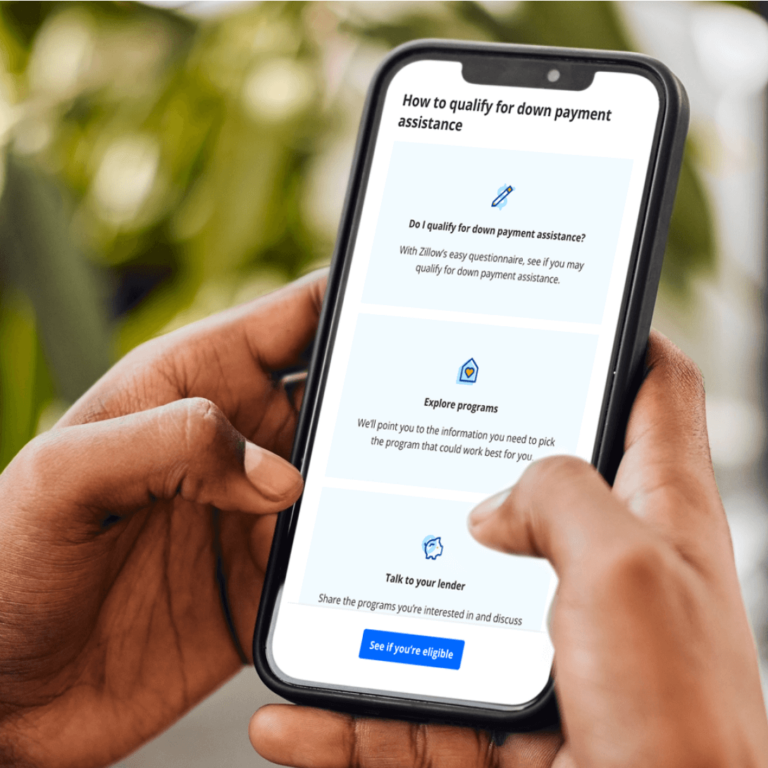

Down payment assistance

Down-payment assistance programs can help home shoppers lower mortgage payments, build home equity faster or even purchase a home sooner. The average assistance for a qualified household buying a starter home is $17,000, according to Down Payment Resource.

Home listings on Zillow display available local programs that can help eligible shoppers with a down payment — the biggest barrier to homeownership for most. A 20% down payment is nice to have, but not necessary. It’s possible to qualify for a home loan with a down payment as low as 3%.

Improving a credit score

For prospective buyers, a higher credit score can improve the chances of getting a lower interest rate on a mortgage. Buyers who have lower credit scores will especially benefit from building their credit before applying for home financing.

Renters’ on-time monthly payments made through Zillow can now build or enhance their credit history.

How agents help

Agents can ensure both buyers and sellers are faithfully represented in a home transaction. They can help buyers hone in on homes that meet both their needs and their budget, use negotiation strategies to get a better deal, and ensure that all contractual obligations are fulfilled, so buyers don’t wind up in legal or financial hot water. That’s why 89% of buyers use a real estate agent or broker.

Agents help sellers too, by making sure their home is well marketed and appropriately priced. While attractive listings are selling fairly quickly, many are receiving price cuts to bring in buyers.